Foreclosure Fraud For Dummies, 2: What is a Note, and Why is it So Important?

The SEIU has a campaign: Whereâs the Note? Demand to see your mortgage note. Itâs worth checking out. But first, what is this note? And why would itâs existence be important to struggling homeowners, homeowners in foreclosure, and investors in mortgage backed securities?

Thereâs going to be a campaign to convince you that having the note correctly filed and produced isnât that important (see, to start, this WSJ editorial from the weekend). This is like some sort of useless cover sheet for a TPS form that someone forgot to fill out. That is profoundly incorrect.

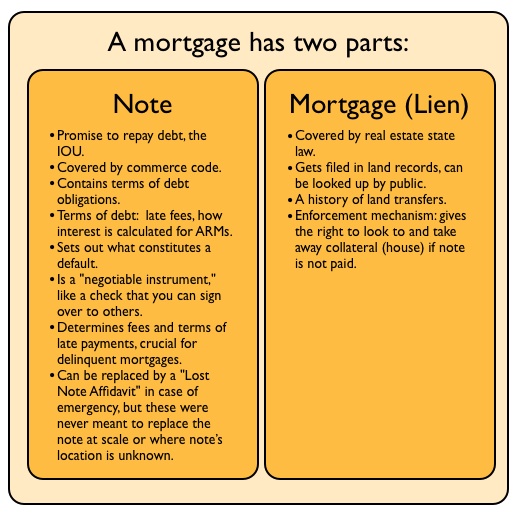

Independent of the fraud that was committed on our courts, the current crisis is important because the note is a crucial document for every party to a mortgage. But first, letâs define what a mortgage is. A mortgage consists of two documents, a note and a lien:

The note is the IOU, itâs the borrowerâs promise to pay. The mortgage, or the lien, is just the enforcement right to take the property if the note goes unpaid. The note is crucial.

Why does this matter? Three reasons, reasons that even the Wall Street Journal op-ed page needs to take into account. The first is that the note is the evidence of the debt. If it isnât properly in the trust then there isnât clear evidence of the debt existing.

And it canât be a matter of âletâs go find it now!â REMIC law, which governs the securitization, is really specific here the securitization canât get new assets after 90 days without a major tax penalty, and it canât get defaulted assets at all without a major tax penalty. Most of these notes are way past 90 days and will be 3in a defaulted state.

This is because these mortgage-backed securities were supposed to be passive entities. They are supposed to take in money through mortgage payments on one end and pay it out to bondholders on the other end, hence their exemption from lots of taxes; the tradeoff is that they canât be de facto managers of assets, and thatâs what going to find the notes would require.

For Distressed Homeowners

The second is that it also matters a great deal for homeowners who are distressed. The note lays out the terms of late fees and other penalties. As we will discuss in the next section about mortgage servicers, the process of trying to get people behind on their payments current instead of driving them into bankruptcy has broken down. But for now itâs clear that mortgage servicers donât have great incentives to get the record of people who are distressed correct.

Thereâs well-documented evidence that extra fees are tacked on to mortgages that have fallen behind, fees that arenât following the terms of the note. This is usually only found out in bankruptcy where there is a lawyer (and multiple parties), not in foreclosure cases

Pages: 1 2

Tags: deal, Foreclosure, isn, mortgage backed securities, remic, wall street journal

Related Articles: